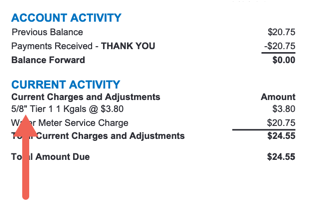

Rates and Charges

Our rates are based on water usage per 1,000 gallons, then multiplied by the corresponding rate of each tier block. In addition, customers are also charged a fixed monthly service charge and a power adjustment charge on their monthly water bill.

General Use Rates

Not Sure What Meter Size You Have?

Check your water bill under ‘Current Activity’ to find out. If you don’t have your bill on hand, a good rule of thumb is to use 5/8″ since this is the most common size.

Service Charge

For each service there shall be a charge per month imposed based on the size of the meter, or its service capacity equivalence in the case of parallel meters, as follows:

| Meter Size | Effective 1/1/12 | Effective 7/1/12 | Effective 7/1/13 | Effective 7/1/14 |

|---|---|---|---|---|

| 5/8″ | $12.00 | $14.40 | $16.00 | $17.75 |

| 3/4″ | $16.75 | $20.00 | $22.25 | $24.75 |

| 1″ | $24.25 | $29.50 | $32.75 | $36.50 |

| 1-1/2″ | $46.00 | $53.00 | $59.00 | $65.50 |

| 2″ | $70.00 | $81.00 | $90.00 | $100.00 |

| 3″ | $132.00 | $146.75 | $163.00 | $181.00 |

| 4″ | $216.00 | $240.00 | $267.00 | $297.00 |

| 6″ | $420.00 | $475.00 | $528.00 | $587.00 |

| 8″ | $680.00 | $755.00 | $840.00 | $934.00 |

Use Charge

In addition thereto, there shall be a consumption charge imposed per 1,000 gallons as follows:

| Use Rate Block | Effective 1/1/12 | Effective 7/1/12 | Effective 7/1/13 | Effective 7/1/14 |

|---|---|---|---|---|

| 0th Block | $3.20 | $3.40 | $3.60 | $3.80 |

| 1st Block | $3.50 | $3.90 | $4.35 | $4.85 |

| 2nd Block | $4.25 | $4.50 | $5.05 | $5.65 |

| 3rd Block | $6.85 | $7.60 | $8.50 | $9.50 |

| 4th Block | $7.20 | $8.05 | $8.95 | $10.00 |

The 0th, 1st, 2nd, 3rd, and 4th block consumption thresholds vary with the size of each meter, and shall be as follows in thousands of gallons per monthly billing:

| Meter Size | 0th Rate Block: Minimum | 1st Rate Block: From-To | 2nd Rate Block: From-To | 3rd Rate Block: From-To | 4th Rate Block: Over |

|---|---|---|---|---|---|

| 5/8″ | 1 | 1 – 7 | 7 – 14 | 14 – 18 | 18 |

| 3/4″ | 2 | 2 – 29 | 29 – 57 | 57 – 65 | 65 |

| 1″ | 3 | 3 – 68 | 68 – 137 | 137 – 175 | 175 |

| 1-1/2″ | 10 | 10 – 169 | 169 – 337 | 337 – 387 | 387 |

| 2″ | 12 | 12 – 400 | 400 – 750 | 750 – 925 | 925 |

| 3″ | 50 | 50 – 600 | 600 – 1,200 | 1,200 – 1,750 | 1,750 |

| 4″ | 175 | 175 – 1,000 | 1,000 – 2,500 | 2,500 – 2,750 | 2,750 |

| 6″ | 225 | 225 – 4,000 | 4,000 – 7,500 | 7,500 – 10,000 | 10,000 |

| 8″ | 250 | 250 – 1,000 | 1,000 – 2,500 | 2,500 – 12,500 | 12,500 |

Wharfage Fee

Where applicable, the Department of Transportation’s wharfage fee shall be charged in addition to the above use and service charges.

Bulk Rates

Bulk rates for specified areas may be established by the Board providing the following conditions are met:

- The area consists of existing dwellings or business establishment with bulk rates built prior to September 11, 1992.

- The system has been offered to the Board but refused because of substandard or obsolete pipeline and fixtures.

- The lots or parcels are under diversified ownership and not under a single or limited number of owners (three (3) and less).

- There is a savings to the Board in maintenance and operating costs in contrast to accepting the system.

- All bulk rates shall be renegotiated biennially and may continue upon concurrence of both parties.

Agricultural Rates

Service Charge

For each agricultural service there shall be a charge per month imposed based on the size of the meter, or its service capacity equivalence in the case of parallel meters, as follows:

| Meter Size | Effective 1/1/12 | Effective 7/1/12 | Effective 7/1/13 | Effective 7/1/14 |

|---|---|---|---|---|

| 5/8″ | $15.00 | $15.00 | $16.00 | $17.75 |

| 3/4″ | $20.00 | $20.00 | $22.25 | $24.75 |

| 1″ | $30.00 | $30.00 | $32.75 | $36.50 |

| 1-1/2″ | $55.00 | $55.00 | $59.00 | $65.50 |

| 2″ | $90.00 | $90.00 | $90.00 | $100.00 |

| 3″ | $160.00 | $160.00 | $163.00 | $181.00 |

| 4″ | $260.00 | $260.00 | $267.00 | $297.00 |

| 6″ | $500.00 | $500.00 | $528.00 | $587.00 |

| 8″ | $800.00 | $800.00 | $840.00 | $934.00 |

In addition to the agricultural service charge described in this Section III, for all water drawn, where such water is used for agriculture, stock raising, or dairy farming on a commercial basis, the following consumption charge shall be imposed for each 1,000 gallons used, as of the following effective dates:

| Use Rate Block | Effective 1/1/12 | Effective 7/1/12 | Effective 7/1/13 | Effective 7/1/14 |

|---|---|---|---|---|

| 1st Block | $1.75 | $1.90 | $2.05 | $2.20 |

In order to qualify for the charges and rates described in this Section III, the applicant shall file annually with the Department of Water a written application, shall furnish annually satisfactory proof, including State of Hawaiʻi General Excise Tax License for the engagement of business in agriculture, stock raising or dairy farming on a commercial basis and shall have a DOW approved reduced pressure backflow preventer installed on the customers side of the meter with a current inspection certificate. The applicant for agricultural rates must agree to accepting service from the Department of Water on an interruptible basis; i.e., the Department retains the right to limit or restrict water flow for agricultural uses in the event of water shortage or in the event water service to domestic users is curtailed due to agricultural uses. The agricultural rates shall not apply to processing activities, such as canneries, mills, markets or other establishments engaged in the conversion, treatment or packaging of agricultural products

Shipping Rates

For each ship or vessel served, there shall be both an opening charge and a closing charge imposed as follows:

Opening and Closing Charges

- Charges applicable during regular Water Department working hours: $53.00

- Charges applicable during Saturdays, Sundays, State of Hawaiʻi holidays, and hours other than regular Water Department working hours: $123.00

Additionally, for all water drawn by ships and vessels, there shall be a consumption charge imposed for each 1,000 gallons of water drawn, as follows:

- Effective January 1, 2009: $3.70

- Effective January 1, 2010: $4.00

Additionally, for all water drawn by ships and vessels, there shall be a State of Hawaiʻi Department of Transportation wharfage fee which is the current approved rate as per the Hawaiʻi Department of Transportation Approved Rate imposed for each 1,000 gallons of water drawn.

Private Fire Service Charges

Public Fire Service Charges

For each fire hydrant or standpipe connected to operating pipelines of the Department of Water, there shall be a charge imposed against the County of Kauaʻi as follows:

| Type and Size | Effective 1/1/12 | Effective 7/1/12 | Effective 7/1/13 | Effective 7/1/14 |

|---|---|---|---|---|

| 2-1/2″ Standpipe | $7.75 | $8.75 | $9.75 | $10.75 |

| 4″ Hydrant | $16.50 | $18.50 | $20.50 | $23.00 |

| 6″ Hydrant | $48.50 | $54.00 | $60.00 | $67.00 |

Other Charges

Temporary Grants of Water

Cost of Power Adjustment Clause

All water consumption (for general use, agriculture use and ships) shall be subject to the imposition of a Cost of Power Adjustment as part of all water consumption charges.

The Department will review the actual unit costs of power for each twelve month period ending March 31st as part of the Department’s annual budget review process. The power cost adjustment for the upcoming fiscal year will be calculated as the sum of the following two components:

- the difference (plus or minus) between budgeted unit power costs for the upcoming fiscal year and the projected unit power costs, and

- the difference (plus or minus) between the actual unit power costs incurred during the twelve- month period ending March 31 st as previously described and the projected unit power costs.

The sum of these two components, calculated on a dollar[s] per thousand gallons basis, will be applied to all water consumption.

Any power cost adjustments will be implemented on July 1st of each year.

Late Charges

A late payment charge may be applied to any delinquent balance payable to the Department. The late payment charge shall be assessed at the rate of half a percent (0.5%) for each month or fraction thereof against the delinquent balance, beginning 30 days after the date of the bill.

For the purposes of this section, ‘delinquent balance’ includes any loan, fee, charge, or other liquidated sum which is 30 days past due to the Department, regardless of whether there is an outstanding judgment for that sum, and whether the sum has accrued through contract, subrogation, tort, operation of law, or administrative order.